If you plan to travel in 2023, you’ll want to ensure you have the right financial tools to manage your money. Travel money cards can be an excellent option for international trips, as they allow you to avoid the high fees associated with traditional credit and debit cards. Here are the four best travel money cards for 2023 that you should consider.

What are Prepaid Travel Cards?

Prepaid travel cards are a type of payment card that you can load with a specific amount of money, which can then be used to make purchases and withdraw cash while traveling abroad. They work similarly to a debit card, but you don’t need to link them to your bank account. Instead, you can reload them with money as needed.

How do Prepaid Travel Cards work?

Prepaid travel cards work by pre-loading money onto the card before your trip. You can load funds onto your card using a mobile app, online banking, or by visiting a participating bank or retailer. Once the card is loaded, you can use it to make purchases or withdraw cash from ATMs just like a regular credit or debit card.

Benefits of Prepaid Travel Cards

- No Foreign Transaction Fees – With prepaid travel cards, you won’t be charged any foreign transaction fees, which can save you a lot of money in the long run.

- Better Exchange Rates – Most prepaid travel cards offer better exchange rates than traditional credit or debit cards. You can get a better deal on your foreign currency by using a prepaid travel card.

- Budgeting and Security – Prepaid travel cards can help you stick to a budget while traveling, as you can only spend the amount of money loaded onto the card. Additionally, you won’t have to worry about the card being linked to your bank account, making it a safer option to use when traveling.

How to Choose the Right Prepaid Travel Card

When choosing a prepaid travel card, there are several factors to consider, including:

- Fees – Look for a card with minimal fees, including loading fees, ATM fees, and foreign transaction fees.

- Exchange Rates – Check the exchange rates offered by the card to ensure you get a good deal on foreign currency.

- Security – Choose a card with high-security features, including chip-and-pin technology, fraud protection, and the ability to lock and unlock the card.

Revolut Card

The Revolut card is a popular choice for travelers, thanks to its no-fee payments and exchanges in over 30 currencies. The standard plan includes free exchanges Monday through Friday and a 1% fee on weekends. Additionally, the card allows for free ATM withdrawals of up to £200 or 5 withdrawals per month. If you need more, paid membership options are available for bigger fee-free allowances and additional perks. You can use the card instantly with Google Pay or Apple Pay, and the physical card costs £4.99. However, note that the account can only be managed through the app.

Wise Travel Money Card

The Wise Travel Money Card is another great option for international travel. It allows you to exchange over 50 currencies with no fees and uses interbank exchange rates plus a 0.41% fee (as shown on its cost calculator). You can withdraw up to £200 twice a month for free, and if you go over that limit, you’ll pay 50p per transaction plus 1.75%. You can use the card instantly with Google Pay or Apple Pay, and the physical card costs £5 or £17 for express delivery. The Wise Travel Money Card can be managed through the app or online.

Monzo Bank Card

The Monzo Bank card uses Mastercard’s exchange rate, making it a great option for no-fee payments abroad. You can withdraw £250 for free in the EEA every 30 days, and £200 for free outside of the EEA every 30 days. If you use Monzo as your main account or have Monzo Plus or Premium, you may be eligible for larger withdrawal limits. You can use the card instantly with Google Pay or Apple Pay, and the physical card costs £5 or £17 for express delivery. The account runs a ‘soft check’, which won’t leave a permanent mark on your credit report if you are not accepted. The account can be managed through the app or online.

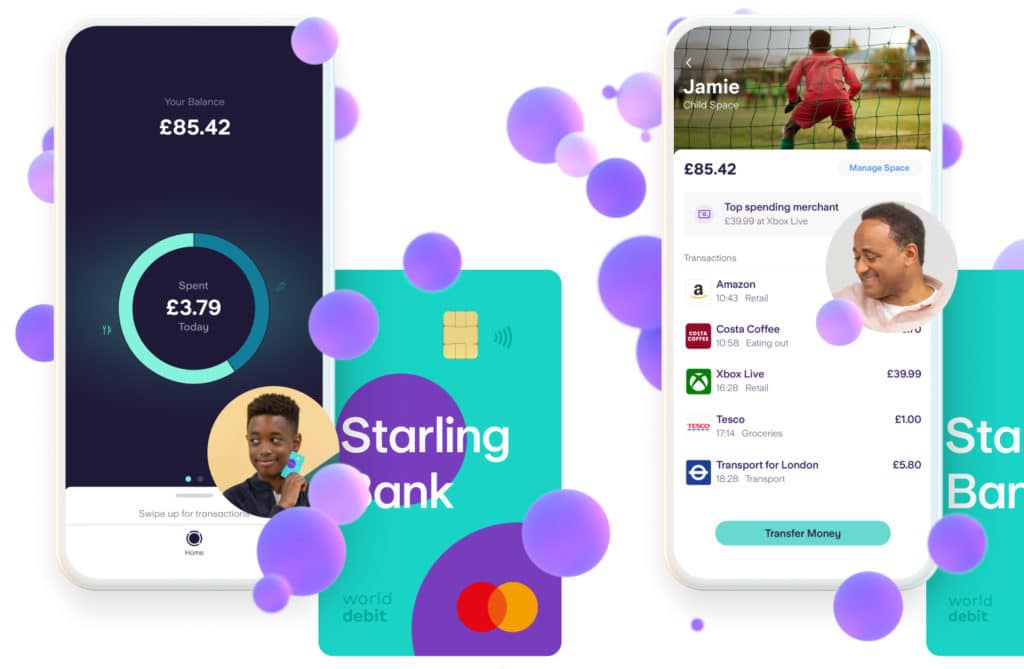

Starling Bank Card

The Starling Bank card is a Mastercard that can be used abroad without any fees for paying by card, using Mastercard’s exchange rate. It allows for cash withdrawals anywhere abroad, with no fees, and the only limit is six withdrawals a day with a daily limit of £300. You can use the card instantly with Google Pay or Apple Pay, and the physical card costs £5 or £17 for express delivery. The account runs a ‘soft check’, which won’t leave a permanent mark on your credit report if you are not accepted. The account can be managed through the app or online.

What happens in case the company goes bankrupt or I lose my card or phone is a common concern for users of online banking services. Here’s what you need to know about the policies of N26, Monese, Revolut, and Wise regarding these situations.

If the company goes bust:

- Monese: Monese accounts are not protected by the Financial Services Compensation Scheme (FSCS). However, Monese is licensed as an Electronic Money Institution (Number 900010) and customer accounts are kept segregated from Monese’s own accounts. If Monese goes bust, their customer would receive 100% of their balance back.

- Revolut: Revolut’s customer funds are not guaranteed by the FSCS, but as an authorized Electronic Money Institution by the FCA, Revolut keeps its customers’ funds separated from its owner. In case of insolvency, customers would be able to claim a full refund. However, if the bank where Revolut stores its customers’ funds goes bust, the money would not be guaranteed.

- Wise: Your balance on Wise’s borderless account is not guaranteed by the FSCS. However, as an Electronic Money Institution, Wise is required by law to keep your money safe and segregated from its own account. If Wise goes bust, your money will be refunded to you in full. However, if the bank where TransferWise stores its UK and European customers’ funds go bust, the return of your money would not be guaranteed.

What if I lose my phone?

- Starling Bank: If you lose your smartphone, you can keep managing your account with the Starling Bank web interface. You will need to disconnect your old smartphone from your account by talking with the support, and then you’ll be able to pair a new smartphone to your account.

- Monese: You can only access your Monese account from one device at a time. In order to register a new smartphone to your account: download the app on your new phone, log in with your email address, and confirm your new smartphone via the email you’ve just received.

- Revolut: If you lose your phone, your Revolut card will still work. However, you’ll need to install the app on a new smartphone, enter your phone number, and select “I haven’t received a code yet” to speak with a support agent (as you won’t be able to receive the validation SMS). As Revolut customer accounts can’t be managed on the web, it’s the only way that you’ll be able to manage your account if you lose your phone.

- Wise: With Wise, you’ll still be able to use your card and manage your account online. However, if you have an SMS validation activated to access your account, you’ll need to call support to change your phone number.

What if my card is lost or stolen?

- Starling Bank: You can block/unblock the card at any time in the Starling Bank mobile app. If you’ve definitely lost your card, you can reorder a new one in your Starling Bank account settings.

- Monese: Immediately go into the Monese app and report your card as Lost/Stolen. A new card will be sent to your address, and the old card will be blocked. If you don’t have access to your mobile app, call Monese Support as soon as possible. If you’re not sure where your card is, you can lock it and unlock it later if you find it.

- Revolut: You can block your card from the app at any time and reorder a new card. If you’re not sure where your card is, you can freeze it and unlock it later if you find it.

- Wise: You can freeze your card from the app at any time and order a replacement within the Wise mobile app or web interface

Conclusion

Travel money cards can be a great way to save money on fees and manage your finances while traveling. The Revolut card, Wise Travel Money Card, Monzo Bank Card, and Starling Bank Card are all excellent options for 2023. Consider the benefits of each card and choose the one that best fits your travel needs. With the right card in your pocket, you can focus on enjoying your trip, without worrying about your finances.

Live Your Life !

Live Your Life !